GST (goods and services tax) has been introduced in India from the first of July. Though the entire process of getting registered under the GST is simple and online, everyone is still confused. Every individual running a business need to get registered under the GST, especially those business entities who carry out taxable supply of goods and services. It is also mandate for those whose annual turnover exceeds the threshold limit of twenty lakhs.

GST registration is critical as it will enable you to avail various benefits such as input tax credit and output tax credit provided under the GST regime. The burden of multiple taxes will be removed from the businesses as well as the consumers with a single GST tax. It is, therefore, important to apply for the GST registration timely to avoid the interface with the tax authorities. Before proceeding to the step by step guide, we should know various other factors related to GST. Let’s discuss.

Liability to Enroll

Existing taxpayers or any individual who is registered with the following authorities is liable to get enrolled under the GST.

- State sales tax/VAT (except liquor dealers)

- Central Excise

- Entry tax

- Service Tax

- Entertainment tax

- Luxury Tax

Types of GST Registration

Every taxable person who owns a business is required to get registered under the GST regime. But before getting registered, it’s important to know about the different types of GST registrations available according to the annual turnover of the business.

Casual Registration

Casual registration is a type of GST registration for taxpayers who deals with the supply of goods and services in a union territory but there is no fixed place of business. Such individuals are considered as a casual taxable person as per the GST Law.

Composition Scheme Registration

Composition scheme is an option provided to the small businesses whose annual turnover is less than seventy five lakhs. Under the GST composition scheme the businesses required to pay the tax at a nominal rate of around one to two percent. It will help small business to maintain less records as they need to pay the tax on a quarterly basis. Despite of having scheme benefits, the small businesses will not be able to claim any input tax credits as they are not eligible to issue invoices.

Multiple GST Registrations

If an individual is running multiple businesses within a state may obtain a separate registration for each business vertical. If a person has branches of businesses in different states, in that case, he or she needs to apply for multiple registrations under the GST. Make sure that you to have your PAN card details with your before the process.

Steps to Get Registered Under the GST

- Verification of the Details: Firstly, you need to create a login account on the GST website in order to initiate the registration process. You need to submit your mobile number, email, and PAN on the GSTN portal. The PAN will be verified online automatically whereas the email and mobile number will be verified on the basis of OTP (One Time Password).

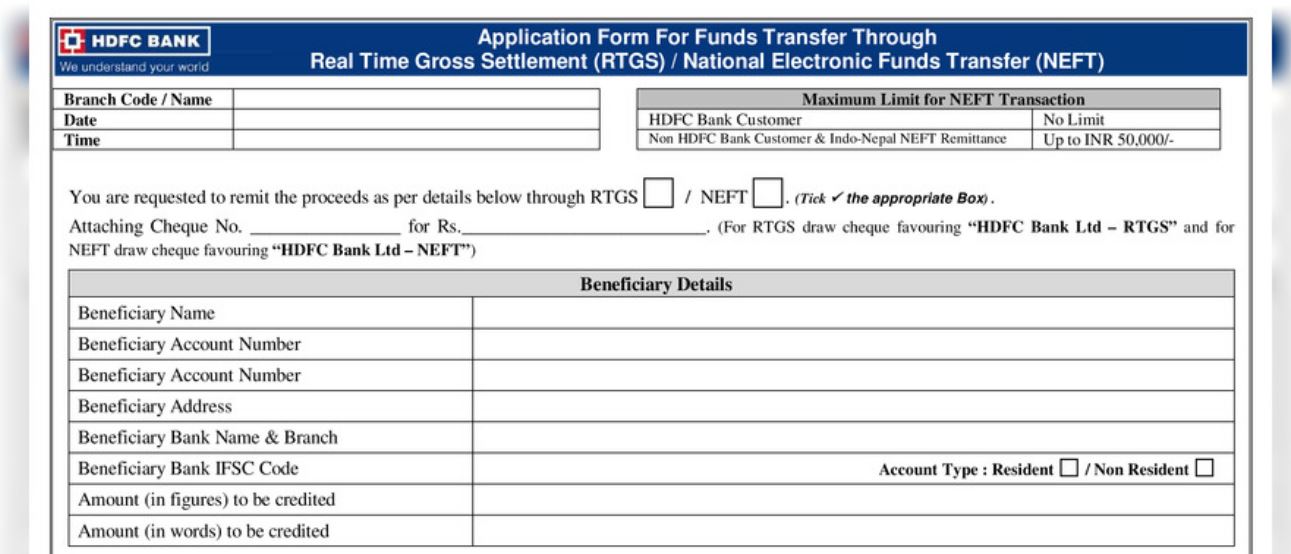

- Submission of Application Form: Once the details you have provided are verified, you have to fill the application form and complete the related formalities such as uploading of the various documents required for GST registration such as constitution of taxpayer, photograph, proof of principle place of business, and bank account details.

- Verification of the Application by GST Officer: After submitting the application form, it will be forwarded to the authorized officer who will cross verify the details and the documents attached. If the officer finds everything justified, your GST registration will be granted within three working days. In case of any issues, the applicant will be informed within three days of submission for the same so that requirements can be fulfilled and given back to the authorized officer for the verification.

- No Action from Authorized Officer: if the officer does not respond within the three working days from the date of form submission, the applicant will be granted with the GST registration approval.

- GST Registration Certificate: After the approval of your application, you’ll be provided with the registration certificate through a common portal. You can easily download the certificate using your login credentials.

- Multiple Registrations: If you have different branches of your business in different states, separate GST registration needs to be done.

Penalties Involved for not Registering Under the GST Act

If in case, a person who runs a business does not get registered under the GST, does not pays tax or make short payments is offended with the penalty of ten percent of the tax amount due on him which is equal to around ten thousand rupees. If the individual is dealing with deliberate frauds, hundred percent penalty will be charged.

Wrapping Up

GST is now the truth and reality which seems to be complex and stringent in the beginning when it comes to compliance. GST is thought to bring the big change for the country’s economy and growth. So, let’s see how effective it would be for our country’s future.

Reference: Step by Step Gst Registration Process Online