What is Forex?

Forex trade is the business activity in which the trade is made between the two currencies of two different countries. In Forex trade, the currency in hand is exchanged with other currency, and some agreed amount of money is charged for transferring the money from one currency to another currency.

In Forex trade, there is no other commodity in a deal but only the currency of two countries. The forex trade is regulated by the international trade body that controls the complete process of foreign exchange. In Forex, the exchange of the money gives one currency to the traders and receives another.

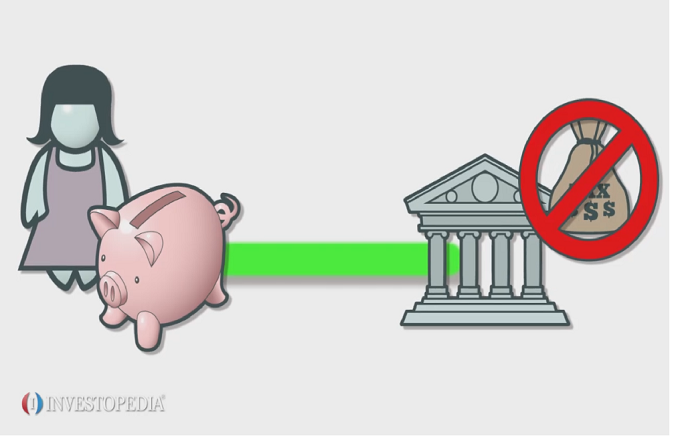

Money Remittance

Remittance of money is the transfer of money from one country to another country. This service is mostly used by the people who work in other countries and want to send money to the families and also for the people who do international business. Here the sender of the money and the receiver of the money is mostly different. There are global money remittance services providers available with the international remittance services scale. Some of the remittance service providers are Western Union Money Transfers, INSTAREM, and many others. So the next time you want to wire money to Philippines, India, Nepal or any other country these service providers can come handy to you.

Forex and remittance are different activities but related and affected by each other

The rates of the Forex for two or more different currency are determined by the demand and supply of the currency. When the money sends through remittance increases over other currency, it affects the Forex rate of one currency over another. Let say, the business man from Australia purchases goods from the USA, in this case, the trader has to pay to the supplier in USD, but the purchaser will pay in the Australian dollar, in this case, the demand for the USD increases. The increasing demand for USD will increase the value of USD in International market and decrease the value of Australian dollar.

So it is obvious that when the remittance exchange of the currency increases the value of the currency in Forex market.

Money remittance helps to boost up the value of one currency in international market, when the value of the currency decreases, the workers do not send money to be converted into that currency, this action stop the conversion of the two currencies for some time, this lead to increase the value of the dependent currency in international market.

Both Remittance and Forex market are interdependent, but currency conversion rate in remittance industry is decided by the Forex market. Conversion of the currencies is totally dependent on the value of the secondary currency in an international market and which is decided in Forex market. On the other hand, high rate of exchange between two monies will affect the Forex rate in the market. It can be said that both are interdependent and complement each other. Mostly the Forex rate is influenced by the remittance when the transaction is done in huge amount such as some government purchases some item from other countries and they need to pay big amount to them, in that case, the rate of exchange of the currency of buying country will be decreasing, and the value of the selling currency will go up. Remittance industry indirectly affects the Forex market and the effect may or may not be seen in the market on real time basis. It can take some to be reflected, but the effect of Forex industry can be seen even per minute on remittance market. One of the most significant similarities in both markets is that both of them deal in two currencies only, there is no commodity between two.

So, it can be said that the Forex market and remittance market is interdependence inter related with each other.