Credit score is the numeric representation of your payment history. A person who has had no credit history has 0 score otherwise the score ranges from 300-900. Two most famous companies where people generally opt for to check their credit score are CIBIL and Experian. Both of these companies have their own importance but there is still a little difference.

Experian is not so popular in India but CIBIL score is the most preferred score by customers as well as lenders. The checking process is almost similar for both but we have still given the steps you can follow to check your Experian credit score and that of CIBIL. Later, you will read about which one is considered to be more powerful and how can you strengthen your score.

How can you check your Experian score?

If you want to check your score, you can follow the simple steps involved in the process:

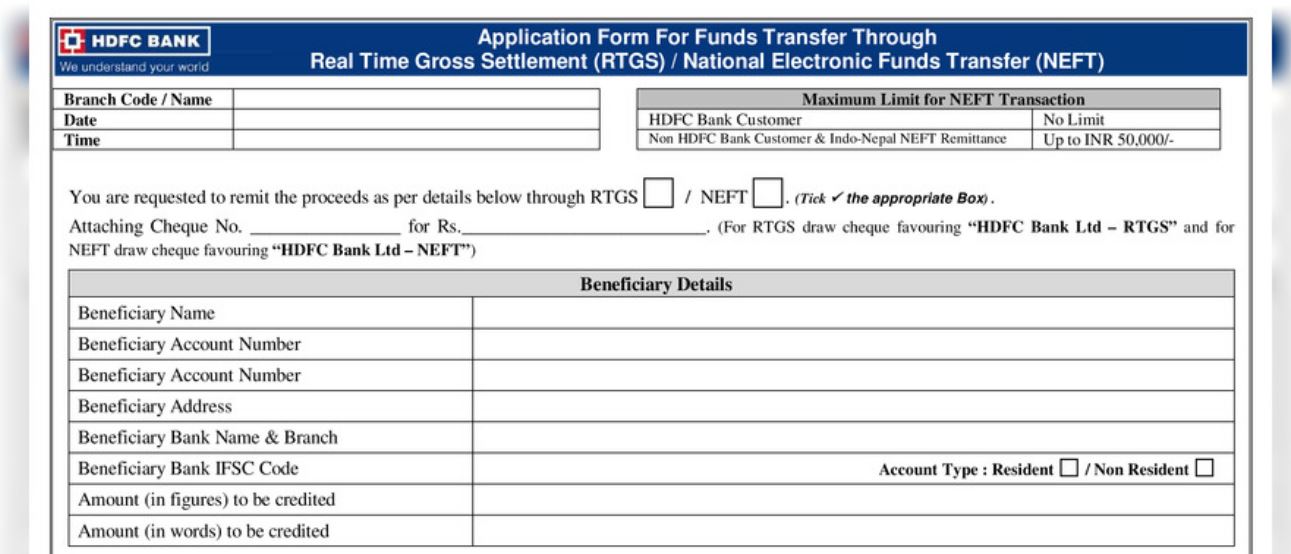

- Provide your Full Name, Mobile Number, and Email ID and click on the ‘Submit’ button.

- You will then receive an OTP on the registered mobile number

- Submit that OTP and click on ‘Verify & Continue’ tab

- Mention your Date of Birth and Gender

- Provide your Permanent Address including the state, city, Pincode

- Enter your Permanent Account Number (PAN) and submit.

How can you check CIBIL score?

You can follow the below steps in order to check your score online:

- Go to check CIBIL score check website

- Provide your full name as mentioned on the PAN card

- Enter your Date of Birth

- Choose the gender you belong to

- Mention your PAN card number

- Enter your contact address

- Provide the email ID fn which you want to get the credit report

- Enter your mobile number

- Submit the form

On the basis of the details you have provided, the credit score would range from 300-900.

What is a good credit score?

The credit score ranges from 300 to 900 where the higher score gives you the option to get desired deals on credit cards and loans. The applicants who have a score above 750 are generally eligible for most the good credit card deals and loans at lower rates.

Importance of CIBIL score

A good credit history gives you the chance to fetch best deals. Focusing on the importance of CIBIL score, you not only increase the chances of getting lower rates on loans and best credit cards. You must have a score of 750 or above to get these benefits. But, if your score is lower than that, you must start working towards improving it.

Here are some of the best options in front of you to improve or generate a good CIBIL or credit score.

- You can apply for a loan or credit card

- Avoid unnecessary usage of credit cards.

- Try to maintain more than 30% of your credit card limit.

- If possible, do not go for prepayment of the loans as it affects the credit score.

Pay your loan EMIs or the credit card bill on time.