A need or wish no longer remains the same when it gets fulfilled. The same goes for the financial goals that are met through a suite of lending products. But, to get an approval for such products, you need to pass the litmus test of credit score, which needs to be more than 700 for an approval.

If it touches 750 and above, not only it becomes easier to get an approval but also brings attractive terms and conditions to make your credit journey a good one. But the question remains, how to get free credit score? Well, you can get it online. Let’s check out the complete process in this article.

Process to Get Free Credit Score Online Detailed Here

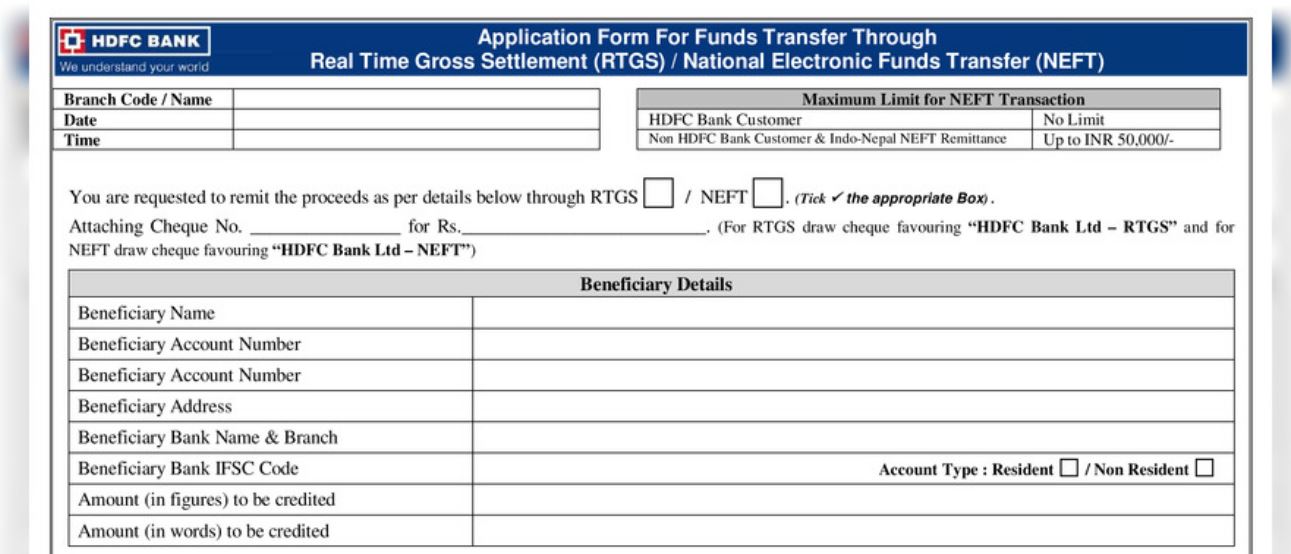

There are many credit information companies offering credit scores and reports to individuals having a repayment track of at least 6 months to a year. One of the most reliable and old credit bureaus operating in India is CIBIL, which assigns you the score based on your repayment behaviour. For a free CIBIL score check, you need a login which you can create mentioning personal and credit details. These details have to be correct and to the best of your knowledge. If you ask about the details, they can be your name, date of birth, PAN number, residence address, loan or credit card account number, card expiry date or the tenure of the loan, etc.

So the details you feed in will get checked by CIBIL thoroughly before it asks you to create a login after verifying the same successfully. You need a User ID and password of your choice for a login creation. These, however, must meet the requirements as stated by CIBIL. You can thus log in to check the score, which is free only once a year. Checking more than that in the same time frame would cost you ₹500 and above.

Ever Wondered How CIBIL Calculates Your Score? No! Check Here

A lot many fail to understand that their weak credit record could blow out the chances of getting an approval for a fresh debt they may apply in the future. What happens is the banks and NBFCs send all the records pertaining to the credit lifecycle of an individual to CIBIL on a monthly basis. So what if it’s about the payment schedule, balance outstanding, skipped payment record, if any, or the debt settlement being exercised by an individual. These records give CIBIL score login a clue about the borrower in you. If the payment history shows a delay or default, don’t be surprised to get a low score which, if below 700, can shut the door for any unsecured debt. Even the debt settlement can bring down the score considerably as it shows you are not able to pay off the dues in full, creating a default image for you. Actually, the debt settlement is an agreement between the debtor and creditor to cut down the size of debt so that the former can pay to the latter comfortably. The creditor agrees and records the transaction as debt settled, which is sent to CIBIL for further introspection. The bureau would look into it and cut down the score as it does not boost the creditworthiness of an individual.