Sense of unrest or anxiety that often haunt the hearts and minds of having to face a debt burden can make a person become stressed and desperate. Difficulty in paying off debt is often experienced by most people who have dependents in meeting the needs of life. Whereby when a person has income and expenditure of the needs that are not balanced, he or she must find a solution to overcome the imbalance. The imbalance makes many people have to borrow money from their friends, Bank, credit unions, and so forth in order to cover up the shortcomings of all their existing needs.

Therefore, they should have the appropriate steps to address these problems in order to pay off existing debts completely.

From the above explanation, there are 6 important steps to overcome your debt soon. Let’s check them out!

1. Calculate the amount of your debt

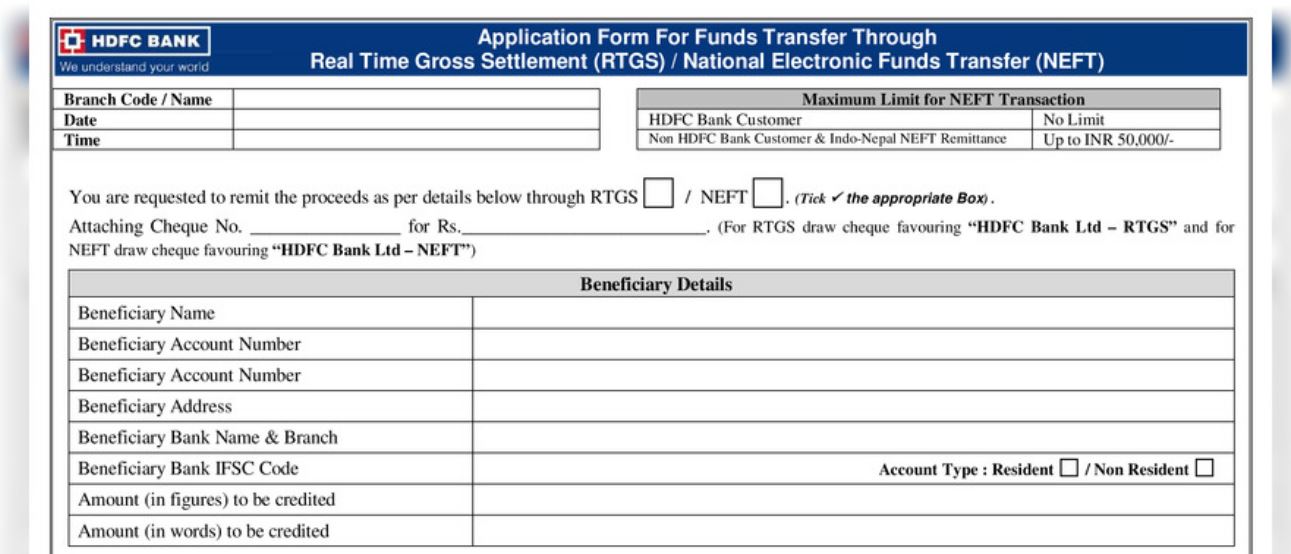

To make the right step so that you can pay off all your existing debts, the first thing you should do is finding out all creditors and how much debt on each of them, then calculating all of the amount of overall debt. By collecting data of bill to be paid and record all debts into one book, you can manage the entire existing debts with ease. You should make a note in the form of tables to be analyzed in detail so that you can determine which debt you must pay in advance.

2. Prioritize more risky debt

Once you have summarized all debts into one record, you need to determine and prioritize the most risky debt, so that you are not dissolved in a prolonged debt so that you can immediately pay off other debts.

3. Determine your income

Determine or calculate all your monthly income amount if needed. There are things need to be known in order to estimate about how much spending that need to be used to pay your debts. Once determined, you may try to get a debt relief. You can find a lot of money institutions, either offline or online. Ask your family and friends for info about where you can get a debt help.

4. Change your wasteful habits

Don’t buy something if you don’t need it. This is a simple advice but often forgotten.

5. Measure your ability to pay

Despite you have to pay or repay all the debts you have, you also need funds for your living expenses. So that you need to think and examine how much money you should spend to pay off your debts. And of course, adjust how much your ability to pay off debts.

6. Realize your plan into action

With all the plans that you have prepared carefully, then it is time you have to pay or repay the debt that you have, in order to be reached at the end point of payment and you can be free from the responsibility of debt that make your life hard.