According to mutual fund advisors, 2019 is going to be a volatile year for the equity and mutual fund investors because of national and international developments like general elections 2019, apprehension of a recession in the US, Brexit, and more. With such powerful events taking place in the political and global environment, it is going to be the best year to invest in safe and secure investments and following diversification as much as possible.

The ideal approach to follow while diversifying your portfolio is to have a mix of long, short and medium-term investments. The short term investments are next to cash and can range from less than or equal to one year whereas the medium term securities range from a period of 3 years to 8 years. The securities with a time frame of more than 8 years qualify as long term securities. Fixed deposits are one of the best investment instruments as they offer flexible tenors and therefore can meet your short-term as well as long-term needs.

Why is 2019 the best time to invest in fixed deposits?

- Increasing interest rates: The interest rates have increased by 5-10 basis points during the last quarter. Both, banks and non-banking financial companies have raised their FD interest rate. For example, Bajaj Finance has increased the interest rates by 0.25% (for tenors between 36 months and 60 months). With this rate hike, you can earn up to 8.75% interest which means this is the best time to lock your money in fixed deposits at higher interest rates with the least risk.

- The falling value of the Indian rupee and the rising crude prices: The value of Indian rupee is falling as it touched 72 against the dollar and crude prices are constantly rising (has almost touched the $65 per barrel mark). In such a scenario going, the interest rates are further expected to rise. So, risk-averse investors and those seeking high-growth can now invest in fixed deposits to earn good returns.

- Increase in the loan to deposit ratio: The loan to deposit ratio was 122% in November 2018 which means that for every 100 rupees collected, banks are lending 122 rupees which lowers their reserves. Under such a situation, banks are concentrating on attracting more money from the investors which can be best done by increasing the interest rates on term deposits or fixed deposits (FD).

Why should you invest in FDs?

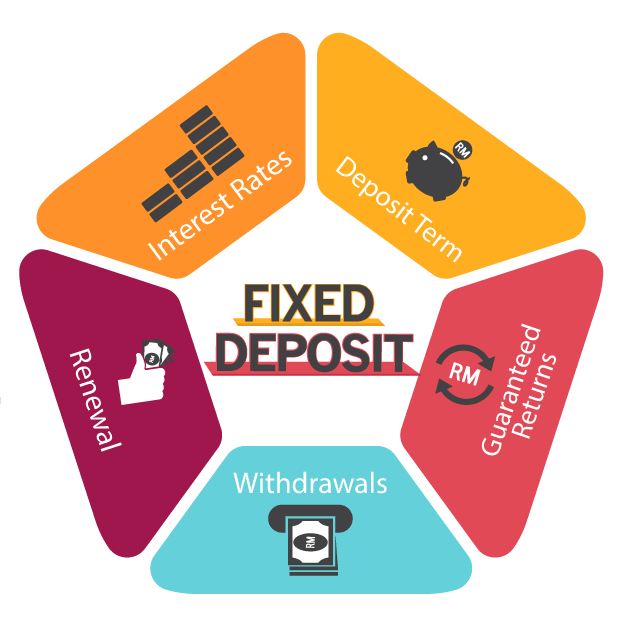

Fixed deposits are a highly preferred investment option. They attract almost 95% of Indian investors because of the wide range of benefits they offer. Some of these benefits are:

- High-interest rates: Savings account gives a return of just 4%-6% whereas the annual returns for liquid funds range between 8.37%- 8.46%. Company FDs offer much higher interest rates.

- Tax saving benefit: FDs with a lock-in period of 5 years provide tax saving benefit. You can grow your money and also enjoy tax rebate (maximum INR 1.5 Lakhs under section 80C). Further, the interest earned on FD is not taxable up to INR 10,000 for normal residents and up to INR 50,000 for senior citizens.

- Flexibility (investment terms): Investing in FD gives you the freedom to receive your interest payouts monthly, quarterly, annually or at the end of tenure. You need not have an account with a particular bank to open the FD account. You also have the flexibility to choose investment tenor (ranging from 7 days to 10 years). Renewals are also very easy.

- Loan against FD: You can also avail a loan against FD to meet any contingencies without having to liquidate or break your FD.

- Highly liquid assets: Fixed deposits are best for investors who need immediate liquidity and retirees because they are highly liquid assets. You can get them encashed anytime you want. Premature withdrawals are hassle free.

The best strategy to invest in fixed deposits

Laddering is the best approach to follow when investing your money in fixed deposits. According to this approach, you should spread the risks of your investment by investing in multiple FDs of different tenors across different financial institutions at different times. This not only ensures better returns but also helps you safeguard your investment against inflation.

Learn more about banking at BankGuide.co.in

You get assured returns on the money you invest in a fixed deposit. FDs also provide great stability where you need not worry about any depreciation of the principal amount. Credible financers, like Bajaj Finance Fixed Deposits, have the highest safety rating of MAAA/stable by ICRA and FAAA/stable by CRISIL.

To earn maximum returns on your fixed deposit investments, you need to be able to manage multiple FDs in the most efficient way. Online account access via Experia- your online fixed deposit account is an easy way to track and manage your FD investments. You can also use the online fixed deposit calculator to calculate your returns and compare various FD schemes.